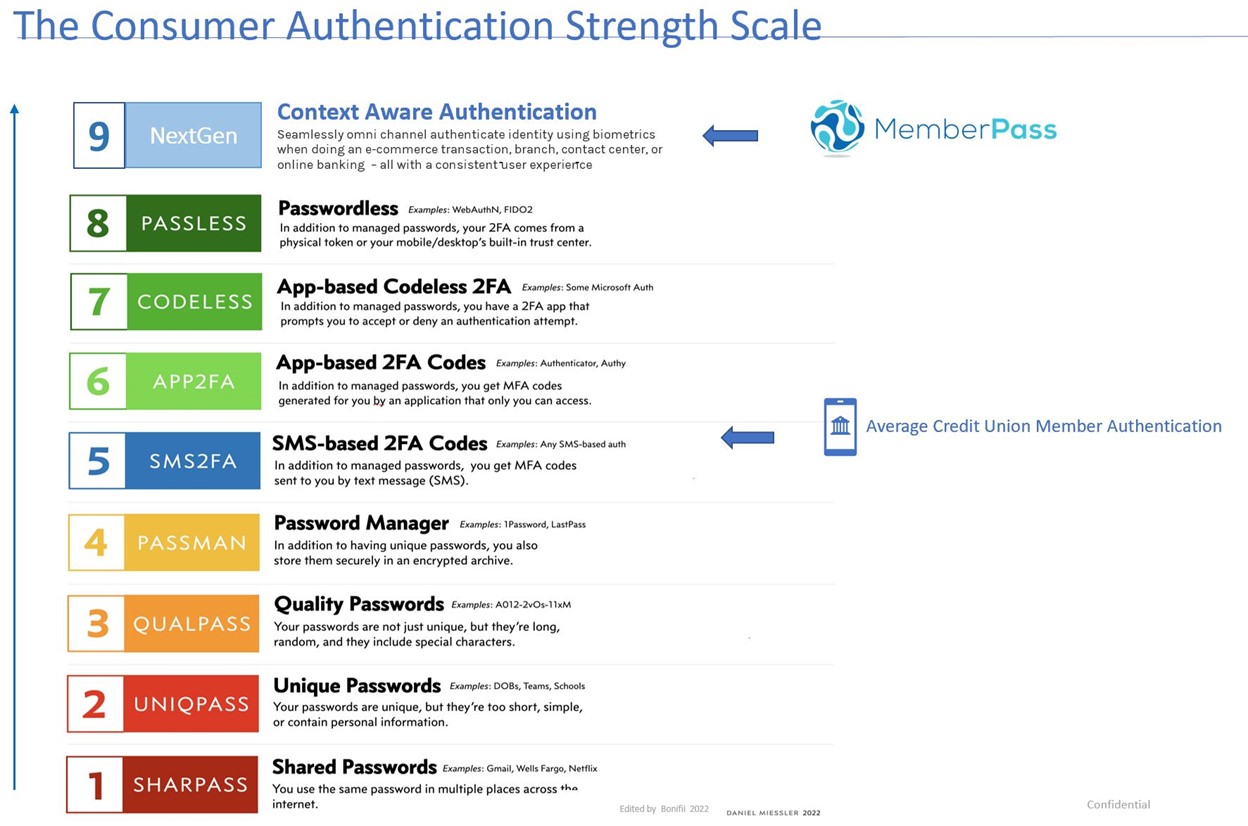

Research tells us it’s probably about level five. MemberPass will boost your members to level nine!

Just as fraudsters use multiple different approaches to perpetrate financial crimes, there are at least nine levels of personal authentication. Authentication is crucial, because virtually all types of financial fraud start with a breakdown of personal identification.

We’ll look at all nine levels. And we’ll pay extra attention to the Next Gen Level 9.

Level one – use a single password for access to multiple websites

This refers to the use of the same text-based password to gain access to as many as 100 or more different websites. Even worse, people often base their passwords on some form of personal information, which increases the potential fraud risk. As a result, this approach to personal authentication is the least secure of all.

The next three levels aren’t much better.

Level two – use of a unique password for each website

Level three – use of a unique high-quality password for each website

Level four – the use of a password-manager app

Level five – two-factor authentication with text messages(this is where most credit unions are today)

This method may use a password-manager app, or it may start with a manually entered username and password. The next step is receipt of a unique numeric access code delivered via text message. Most credit union members’ authentication practices are at this level or below.

Level six – app-generated authentication codes

This level of two-factor authentication uses a password manager and works because the user receives an access/authentication code generated by an app only the user can access.

Level seven – app-based codeless authentication

This next level of authentication also functions via a password manager and an app. The app generates an authentication request which the user can either approve or deny. No code is sent or exchanged.

Level eight – password-less access

This is a technically sophisticated method but it’s simple to use. Authentication for a given website or transaction stems from a token you get from a trust center on your mobile device or computer.

Level nine – context-aware authentication (available with MemberPass)

This is the highest-level authentication experience. It’s seamless across every channel, or transaction type. It uses industry leading technology including; W3C and FIDO (Fast IDentity Online), biometrics and verifies key identifiers such as; identity, behavior, location, device and channel. This form of identity can’t be hacked, forged, stolen, lost, or misplaced. This is the highest level of authentication experience in the market today for your members.

MemberPass® is the safe, private, and secure way for your members to verify their identity.

If you’re ready to take your credit union to the highest level of secure authentication with technology that proactively prevents fraud before it happens, it’s time to learn more about the next generation of MemberPass.

With MemberPass (level nine authentication) you’re already able to:

- Prevent fraud before it happens.

- Complete new-member enrollment with minimal friction.

- Deliver consistent member experiences across all channels and transactions

- Eliminate passwords and challenge questions.

- Avoid hackable central databases of personally identifiable information.

- Enjoy lower expense costs thanks to better fraud protection and less MSR time spent authenticating members.

The new next gen MemberPass gives you these great additional benefits:

- No core integration required

- Deploy in your CU in as few as three days.

- No additional app for members to download.

- Industry-leading security technology (W3C and FIDO2 compliant)

- The ability to detect and determine identity, patterns in behaviors, locations, devices, and channel patterns in real time.

- Next gen MemberPass operates independently from your mobile banking platform.

- Stop online payment fraud in real time for P2P and card transactions.

To learn more about the next gen of MemberPass, contact Dante Terrana today. Reach him at dterrana@bonifii.com, call him at 716-418-6036, or schedule a meeting with him through Calendly.